Australia may be engaging in 'free trade' but it's becoming more protectionist too

- Written by Giovanni Di Lieto, Lecturer of international trade law, Monash Business School, Monash University

The federal government may be aggressively[1] negotiating free trade agreements, but in other ways it is restricting trade[2]. The government has been giving itself extensive new anti-dumping powers, targeting steel and aluminium markets[3] in particular.

There was a nearly two-fold[4] increase in anti-dumping investigations in Australia in 2017. According to the Productivity Commission[5], these protectionist measures “raise costs to consumers and reduce competitive pressures, leading to less efficient resource use in the country levying the protection”.

Higher tariffs lift the costs of imports and disrupt global supply chains. This harms consumers, producers and workers.

The Productivity Commission estimates[6] that for every A$1 increase in tariff revenue, economic activity in Australia falls by A$0.64. The commission also says that for “every year that higher tariffs prevailed, GDP would be lower by over one per cent”. Thus, “a household that spends A$2,500 a fortnight on goods and services would be worse off by A$100 a fortnight”.

Read more: Three charts on: G20 countries' stealth trade protectionism[7]

The Australian Department of Industry[8] explains that:

dumping occurs when goods exported to Australia are priced lower than their “normal value”, which is usually the comparable price in the ordinary course of trade in the exporter’s domestic market.

A recent example of this in action was when the Anti-Dumping Commission found[9] that major exporters of tinned Italian tomatoes were dumping their product in Australia. The government swiftly imposed dumping duties of up to 8.4%[10].

In principle, this is perfectly legitimate. World Trade Organisation agreements[11] allow these duties to be imposed when dumping or subsidisation threaten to cause material injury to a domestic industry.

But recent changes to Australia’s anti-dumping laws[12], while purportedly aimed at “levelling the field”, place a greater legal burden on overseas businesses with more stringent submission requirements.

Moreover, legislative proposals tabled in the federal parliament[13] in late 2017 could vastly expand the discretionary power the government has to set benchmark prices for imported products in the Australian market. These can even be set at higher levels than the prices in the home market from which they were exported.

Indeed, according to international trade law practitioners[14], “dumping duties at high rates will give the Minister an unprecedented price-fixing power over imported products, to the extent that foreign exporters and their Australian importers may be unable to compete in Australian markets”.

In other words, this proposal could exacerbate the trend[15] of covert trade protectionism in Australia.

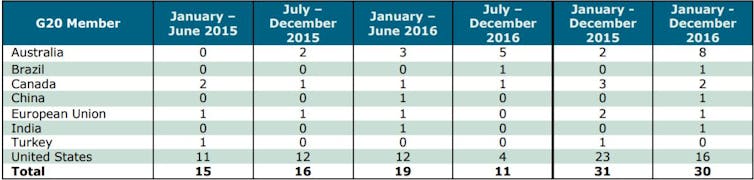

According to a 2017 WTO report on trade measures in the G20 countries[16], new anti-dumping actions have outpaced terminations by three to one. This is the largest gap since 2012. Australia also had a fourfold increase in new countervailing duty measures (trade retaliations, in other words) from 2015 to 2016, second only to the USA. In 2016 Australia started nearly one-third of all G20 trade retaliations.

Initiations of anti-dumping investigations in G20 countries (2016-17)

World Trade Organization

Initiations of anti-dumping investigations in G20 countries (2016-17)

World Trade Organization

Initiations of countervailing duty investigations in G20 countries (2015-16)

World Trade Organization

Initiations of countervailing duty investigations in G20 countries (2015-16)

World Trade Organization

The subjects of anti-dumping actions are usually technical barriers to trade that measurably affect certain industries. In the G20 countries most of these relate to agricultural policies.

Australia has in recent times[17] raised specific trade concerns about the European Union’s agriculture policies, India’s minimum prices for wheat and sugar, Canadian subsidies for milk and wine, and the United States’ purchase of cheese stock, export credit guarantees and international food aid.

Read more: In the economic power struggle for Asia, Trump and Xi Jinping are switching policies[18]

The anti-dumping data and legislative trends clearly show that Australia is at the forefront of the trend[19] towards greater (covert) trade protectionism among developed countries.

Several government policies, including the abolition of the temporary work 457 visas, the Australian Securities and Investments Commission’s exemption of certain foreign financial suppliers from particular regulatory requirements, and the Mobile Black Spot Program (to improve mobile coverage in regional and remote Australia) have also come under scrutiny by the World Trade Organisation[20]

This does not completely undermine Australia’s leadership in new free trade agreements in the Asia Pacific region and beyond. But it does show that Australian trade diplomacy is taking place within the creation of a less-than-liberal order of global economy[21].

References

- ^ aggressively (dfat.gov.au)

- ^ restricting trade (www.afr.com)

- ^ steel and aluminium markets (industry.gov.au)

- ^ nearly two-fold (www.wto.org)

- ^ Productivity Commission (www.pc.gov.au)

- ^ estimates (www.pc.gov.au)

- ^ Three charts on: G20 countries' stealth trade protectionism (theconversation.com)

- ^ Australian Department of Industry (www.aph.gov.au)

- ^ Anti-Dumping Commission found (www.adcommission.gov.au)

- ^ dumping duties of up to 8.4% (www.smh.com.au)

- ^ World Trade Organisation agreements (www.wto.org)

- ^ changes to Australia’s anti-dumping laws (industry.gov.au)

- ^ tabled in the federal parliament (parlinfo.aph.gov.au)

- ^ international trade law practitioners (moulislegal.com)

- ^ the trend (www.wto.org)

- ^ WTO report on trade measures in the G20 countries (www.wto.org)

- ^ in recent times (www.wto.org)

- ^ In the economic power struggle for Asia, Trump and Xi Jinping are switching policies (theconversation.com)

- ^ the trend (theconversation.com)

- ^ scrutiny by the World Trade Organisation (www.wto.org)

- ^ less-than-liberal order of global economy (www.ceda.com.au)

Authors: Giovanni Di Lieto, Lecturer of international trade law, Monash Business School, Monash University