Cushman & Wakefield: Cautious Residential and Investment Markets in 2022

- Written by The Bulletin

Interest Rates Are Expected to Peak in 2023 Further Border Reopening to Bring About Market Stability

HONG KONG SAR - Media OutReach - 15 December 2022 - Global real estate services firm Cushman & Wakefield announced the Hong Kong Property Market 2022 Review and 2023 Outlook today.The overall property market remained quiet in 2022 as investment and business sentiment stayed cautious, impacted by interest rate hikes and other factors such as global economic instability.

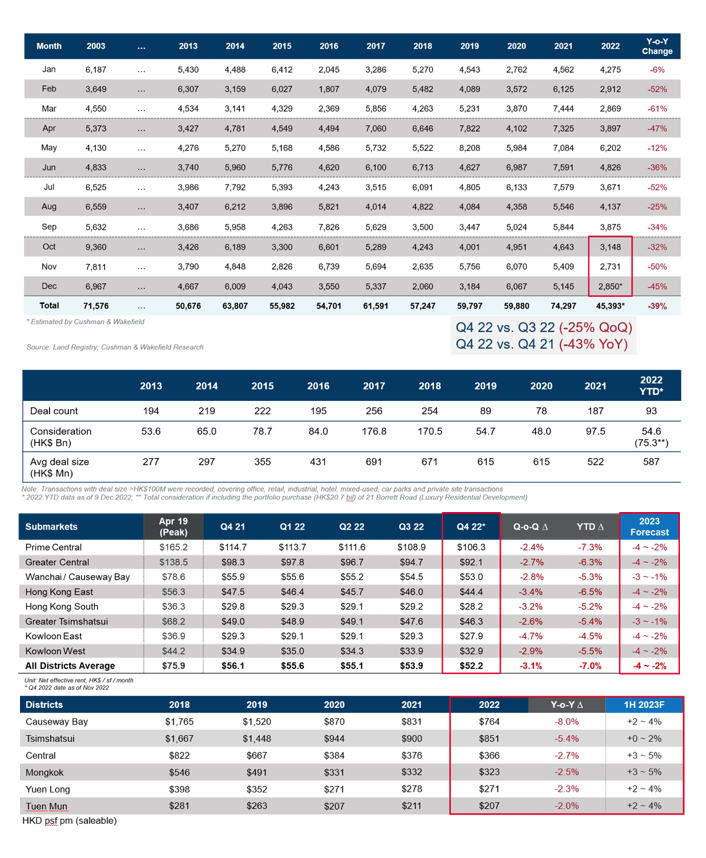

- Residential market transactions slowed noticeably in 2022; full-year transactions are now forecast to record a decade low, with a price decline further accelerating in Q4.

- The large-sized (non-residential, exceeding HK$100 million) real estate investment consideration in 2022 (as of 9 Dec) dropped by almost 45% y-o-y; industrial and development sites remained most attractive to investors.

- 2022 (as of mid-Nov) office net absorption returned to positive territory at 176,000 sq ft NFA, the first positive year since 2019, yet high availability has kept rents under pressure.

- High street retail rents have dropped, but inbound tourist numbers have gradually risen in the last few months, with some retailers strategizing ahead to prepare for further border reopening.

Residential market: Prices dropped more than 10% in 2022 YTD, a further 0%–5% decline is expected in 2023

The residential market slowed noticeably in 2022, with average monthly transactions of less than 4,000 units (Jan to Nov 2022). Whilst buying sentiment in 1H 2022 was mainly affected by the fifth wave of the pandemic, the market witnessed other emerging impacts in 2H 2022, including rising interest rates and stock market volatility, which prompted buyers to remain cautious and transactions to slow in both primary and secondary markets. Total 2022 transaction volume is now estimated at circa 45,400 units, the lowest level of the past decade.

As for residential prices, government data shows that overall property prices retreated by 10.5% in the first 10 months of 2022, and we expect an annual price drop of 12%–13% by the end of this year. Cushman & Wakefield’s home price tracker showed an accelerated price decline in Q4. Prices at City One Shatin (mass market) declined by 18.1% q-o-q, returning to the early-2017 level, whilst Taikoo Shing (mid-market) and Residence Bel-Air (luxury homes) dropped by 14.4% q-o-q and 6.4% q-o-q, respectively.

Cushman & Wakefield’s Executive Director and Head of Research, Hong Kong, Rosanna Tang, said: “Looking ahead to 2023, buyers' appetite will likely still be affected by interest rate hikes and global economic uncertainties, and some homeowners may provide greater room for negotiation due to pressures from rising mortgage payments. Property prices are forecast to further correct in 1H 2023 yet we may see prices stabilize in 2H, as interest rates could potentially peak mid-year, bringing the full-year home price decline into the 0%–5% range. In terms of transaction volume, the primary market transaction slowdown in 2022 may prompt developers to accelerate their new launches in 2023, with prices closer to the secondary market to attract buyers. On a brighter note, a continued upward trend in the stock market next year, coupled with the potential border reopening, could help to bring some positive spin to the city’s economy and housing market, and hence support 2023 residential transactions to rebound by 20%–30% y-o-y, to reach similar levels as seen in 2019 and 2020."

Non-residential Investment Market: Sentiment turned quiet in 2H; 2022 deal count and total considerations to fall behind 2021

Buffeted by interest rate hikes, investors generally adopted a cautious and wait-and-see stance in 2H 2022. The large-sized non-residential transactions (over HK$100 million) stayed relatively quiet with only 93 deals recorded in 2022 (as of 9 Dec), sending total investment volume down by more than 40% y-o-y to HK$54.6 billion, with most transactions front-loaded in 1H 2022. Local investors and developers, as well as institutional funds, were the key purchasers in the market. Defensive assets including industrial and development sites continued to gain traction with investors, thanks to sustained demand for logistics warehouses and new economic sectors such as data centres and cold storage. Some developers were also actively seeking investment partners or operators for joint venture industrial or redevelopment site opportunities.

Cushman & Wakefield’s Executive Director and Head of Capital Markets, Hong Kong, Tom Ko, commented: “Overall investment sentiment in 2023 will be dependent on the pace of interest rate hikes, economic conditions, and progress towards the border reopening with the mainland. Investors will generally opt for higher yield expectations on investments given the current high-rate environment, while most sellers with strong holding power may not be open to price reductions. Therefore, some transactions will take a longer time to conclude. Recently, the market has observed some receivership deals, and some owners are more willing to sell their non-core assets, which may lead to large-sized transactions taking place. In addition, in his latest policy address the Chief Executive proposed to further relax the compulsory sale thresholds for older buildings, which may fast-track urban redevelopment action. The 2023 total transaction volume is expected to rebound from this year's low base, to reach circa HK$70 billion."

Grade A office market: Positive net absorption returned in 2022, yet high availability continues to pressure rents

Overall business sentiment stayed cautious, with some tenants downsizing to save costs amid the global economic downturn. The city’s Grade A office market recorded negative net absorption of 75,400 sq ft NFA in Q4. New leasing transactions continued to be dominated by the banking and finance sector, accounting for a 54% share of the market, while some large-sized deals (exceeding 10,000 sq ft NFA) were from mainland China companies. The 2022 net absorption figure (as at Nov 2022) was 176,200 sq ft NFA, the first positive absorption year since 2019. The performance was an improvement from 2020 (-2.3 million sq ft NFA) and 2021 (-580,000 sq ft NFA), mainly driven by pre-commitment at newly completed projects. However, the new supply in turn further pushed up the overall availability rate to 16.8% in Q4, a new high since Q1 2004. The expanded office space options have exerted pressure on rents, with the overall rental level declining by 7.0% YTD (as of Nov 2022).

John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield stated: “With more new office completions entering the market, coupled with the current attractive rental levels, we believe that occupiers will continue to seize opportunities for upgrading and flight-to-quality moves. Particularly, occupiers are increasingly demanding in their ESG requirements when considering office options. Looking ahead, it is expected that the border will gradually reopen next year, helping to boost office leasing demand from domestic and multinational companies. In 2023, there will be circa 1.89 million sq ft NFA of new Grade A office spaces completed, including two new office projects in Central. The 2023 year-end availability rate is forecasted to reach 18%–19%, while the full-year rental decline is expected to narrow into the 2%–4% range."

Retail market: Retailers strategize ahead for border reopening, high street rents to stabilize in 2023

The first 10 months’ total retail sales fell by 0.7% y-o-y to circa HK$286.8 billion, although daily necessity categories such as medicines & cosmetics and supermarkets performed relatively well, up 2.8% y-o-y and 1.5% y-o-y, respectively. The retail market was predominantly supported by local consumption through 2022 amid the fluctuating pandemic situation, leading to drops in high street rents at traditional tourist areas, including Causeway Bay and Tsimshatsui at 8.0% and 5.4% y-o-y, respectively. Other submarkets fell more moderately, in the 2%–3% range. In terms of F&B rents, overall, Kowloon performed slightly better than Hong Kong Island. Tsimshatsui and Mongkok remained largely stable, while Central and Causeway Bay fell by 2.9% and 0.5% y-o-y, respectively.

Cushman & Wakefield’s Executive Director, Head of Retail Services, Agency & Management, Hong Kong, Kevin Lam, concluded: “Although rental level adjustments continued during the pandemic, high street rents in Hong Kong are still leading the APAC region, reflecting the resilience of the city’s retail market. The recent relaxation of pandemic measures in mainland China has brought about hope for the border reopening with Hong Kong, while inbound visitor arrivals also witnessed a gradual recovery over the last few months. Some retailers who previously exited from core areas have now returned and renewed their retail strategy and recruitment process to prepare for the reopening. As for shopping malls, landlords are more willing to offer flexible leasing terms to attract tenants that could boost footfall, and some are also actively incorporating destination-themed elements into their portfolio to enhance the overall shopping experience. The pandemic has prompted people to put more emphasis on health and wellness, and we saw some expansion demand from athleisure brands and fitness centres, which will continue to help drive the retail market next year. We expect to see high street and F&B rents to recover from this year's low base, by picking up in a 0%–5% y-o-y range in 2023."

Please click here to download photos.

Photo caption:

Picture (Left to right): Tom Ko, Executive Director and Head of Capital Markets, Hong Kong, Cushman & Wakefield, John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield, Rosanna Tang, Executive Director, Head of Research, Hong Kong, Cushman & Wakefield and Kevin Lam, Executive Director, Head of Retail Services, Agency & Management, Hong Kong, Cushman & Wakefield.

Hashtag: #Cushman&Wakefield

The issuer is solely responsible for the content of this announcement.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 23 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.hk or follow us on LinkedIn ( https://www.linkedin.com/company/cushman-&-wakefield-greater-china).