Real estate agents targeting tenants is the lowest of the low blows during election 2019

- Written by Danielle Wood, Program Director, Budget Policy and Institutional Reform, Grattan Institute

The lowest blow of this election campaign may have come from a firm of real estate agents that abused its position of trust to scare renters about Labor’s proposed negative gearing changes.

If you are one of those renters, relax. You have nothing to fear from the changes. You might even benefit from them. The only interests the real estate firm is protecting is its own.

Letter from Raine & Horne principal Graham Cockerill.

Samantha Maiden, Twitter[1]

Letter from Raine & Horne principal Graham Cockerill.

Samantha Maiden, Twitter[1]

Late last week Raine & Horne principal Graham Cockerill wrote to tenants saying Labor’s changes would be “devastating” and including material from the Real Estate Institue of Australia warning of what might happen if “the planned changes to negative gearing do go ahead”.

“The fall in property prices will decrease the value of 18 million Australian’s retirement nest eggs,” and “rents will rise” the material warns. “Further, government savings will be less than estimated, unemployment will rise and our whole economy will be in jeopardy.”

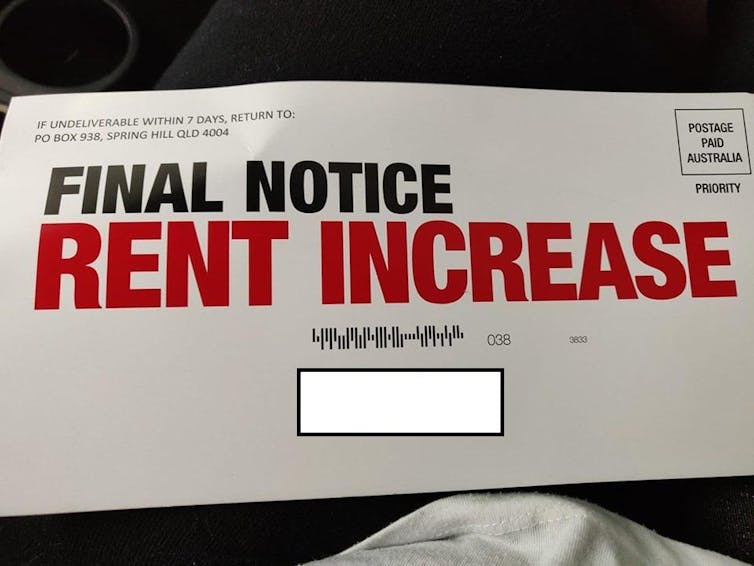

Other renters have received official looking material apparently sent by the Liberal Party reading “Final Notice: Rent Increase”.

Apotheosical, Reddit, Tuesday May 14[2]

It’s a jumped-up scare campaign. But some renters may give it more credibility than it’s worth because some of it comes from the people who normally notify you when your rent is going up.

Here are some facts.

Labor’s policy will not raise rents.

Real estate agents don’t decide rents, landlords do.

The Labor policy won’t fundamentally change the balance of supply and demand in the rental market.

Yes, if there are fewer cashed-up investors that might mean fewer rental properties. But those properties won’t disappear – home buyers will move in, so there will be fewer renters.

And the policy shouldn’t reduce the supply of new homes, because most investment lending goes to existing rather than new homes. Labor’s policy actually leaves in place the tax breaks for people who invest in new homes.

Some of the renters targeted by Raine & Horne might be saving to buy a home. If you are one of them, here are some more facts.

Labor’s policy will help renters buy houses

You stand to benefit from the Labor policy. If there are fewer taxpayer dollars in the hands of property investors, that will boost your prospects of being able to buy a home yourself.

If there is reduced demand from investors, house prices will fall. The fall will be modest – we at Grattan Institute calculate it will be in the range of 1% to 2%[3]. The Commonwealth and NSW Treasuries estimate similar modest price falls.

So what about the headlines you might have seen about 10% or 20% price falls?

All those estimates were prepared by – or paid for by – the property industry. If you detect a pattern you are right. Well-resourced property groups that stand to lose from capital gains tax and negative gearing changes have been muddying the water for a long time now.

The industry talks its own book

Here are a few facts that real estate agents aren’t rushing to tell you. Negative gearing and the capital gains tax discount work together to create a very generous tax regime for the property industry. Investors write off their losses after interest costs in full against the taxes on their wages. But when they sell, they only pay tax on half their gain. Given strong growth in property prices and low inflation, some wage earners end up paying less tax[4] than if they had not invested at all, despite the profits on the investments.

And like most tax concessions, people with higher incomes benefit the most. That’s why the share of anaesthetists negatively gearing is almost triple that for nurses, and the average tax benefits they receive are around 11 times higher.

The end result is that the government has been subsidising investors to buy their second, third or tenth property while at the same time crying crocodile tears about the fact that lots of young people trying to buy their first home are locked out of the market.

Read more:

The Game of Homes: how the vested interests lie about negative gearing[5]

The industry claims of rising unemployment and putting the economy “in jeopardy” show a similar disregard for facts. The Labor policies will collect on average an extra A$3 billion to A$4 billion a year in revenue for the government over the first decade, less than a 1% increase in the total tax take. Much of that money will go back into the economy through reductions in other taxes or increases in spending[6]. Any negative overall effects from the higher levels of tax will be imperceptibly small across a A$1.8 trillion economy.

There is, however, one industry that might go backwards.

Real estate agents take healthy commissions from housing investors. Investors, particularly negatively geared ones, also turn over properties faster than homeowners. So real estate agents benefit when there are more properties in the hands of investors and fewer in the hands of homeowners.

Don’t be scared by the real estate agents’ campaign. Labor’s negative gearing policy won’t raise your rent. And if you’re trying to buy your first home, it just might boost your chances.

Read more:

Confirmation from NSW Treasury. Labor's negative gearing policy would barely move house prices[7]

Apotheosical, Reddit, Tuesday May 14[2]

It’s a jumped-up scare campaign. But some renters may give it more credibility than it’s worth because some of it comes from the people who normally notify you when your rent is going up.

Here are some facts.

Labor’s policy will not raise rents.

Real estate agents don’t decide rents, landlords do.

The Labor policy won’t fundamentally change the balance of supply and demand in the rental market.

Yes, if there are fewer cashed-up investors that might mean fewer rental properties. But those properties won’t disappear – home buyers will move in, so there will be fewer renters.

And the policy shouldn’t reduce the supply of new homes, because most investment lending goes to existing rather than new homes. Labor’s policy actually leaves in place the tax breaks for people who invest in new homes.

Some of the renters targeted by Raine & Horne might be saving to buy a home. If you are one of them, here are some more facts.

Labor’s policy will help renters buy houses

You stand to benefit from the Labor policy. If there are fewer taxpayer dollars in the hands of property investors, that will boost your prospects of being able to buy a home yourself.

If there is reduced demand from investors, house prices will fall. The fall will be modest – we at Grattan Institute calculate it will be in the range of 1% to 2%[3]. The Commonwealth and NSW Treasuries estimate similar modest price falls.

So what about the headlines you might have seen about 10% or 20% price falls?

All those estimates were prepared by – or paid for by – the property industry. If you detect a pattern you are right. Well-resourced property groups that stand to lose from capital gains tax and negative gearing changes have been muddying the water for a long time now.

The industry talks its own book

Here are a few facts that real estate agents aren’t rushing to tell you. Negative gearing and the capital gains tax discount work together to create a very generous tax regime for the property industry. Investors write off their losses after interest costs in full against the taxes on their wages. But when they sell, they only pay tax on half their gain. Given strong growth in property prices and low inflation, some wage earners end up paying less tax[4] than if they had not invested at all, despite the profits on the investments.

And like most tax concessions, people with higher incomes benefit the most. That’s why the share of anaesthetists negatively gearing is almost triple that for nurses, and the average tax benefits they receive are around 11 times higher.

The end result is that the government has been subsidising investors to buy their second, third or tenth property while at the same time crying crocodile tears about the fact that lots of young people trying to buy their first home are locked out of the market.

Read more:

The Game of Homes: how the vested interests lie about negative gearing[5]

The industry claims of rising unemployment and putting the economy “in jeopardy” show a similar disregard for facts. The Labor policies will collect on average an extra A$3 billion to A$4 billion a year in revenue for the government over the first decade, less than a 1% increase in the total tax take. Much of that money will go back into the economy through reductions in other taxes or increases in spending[6]. Any negative overall effects from the higher levels of tax will be imperceptibly small across a A$1.8 trillion economy.

There is, however, one industry that might go backwards.

Real estate agents take healthy commissions from housing investors. Investors, particularly negatively geared ones, also turn over properties faster than homeowners. So real estate agents benefit when there are more properties in the hands of investors and fewer in the hands of homeowners.

Don’t be scared by the real estate agents’ campaign. Labor’s negative gearing policy won’t raise your rent. And if you’re trying to buy your first home, it just might boost your chances.

Read more:

Confirmation from NSW Treasury. Labor's negative gearing policy would barely move house prices[7]

References

- ^ Samantha Maiden, Twitter (twitter.com)

- ^ Apotheosical, Reddit, Tuesday May 14 (www.reddit.com)

- ^ in the range of 1% to 2% (theconversation.com)

- ^ end up paying less tax (grattan.edu.au)

- ^ The Game of Homes: how the vested interests lie about negative gearing (theconversation.com)

- ^ reductions in other taxes or increases in spending (theconversation.com)

- ^ Confirmation from NSW Treasury. Labor's negative gearing policy would barely move house prices (theconversation.com)

Authors: Danielle Wood, Program Director, Budget Policy and Institutional Reform, Grattan Institute