Frydenberg should call a no-holds-barred inquiry into superannuation now, because Labor won't

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

The Coalition is running out of time to do worthwhile things.

Facing overwhelming odds of defeat in the election due within weeks, one of its last throws of the dice should be to do something Labor would never do, but which is urgently needed and would set us on the right course for the future.

It’d also cause some trouble for Labor along the way.

It is to launch a full-blown inquiry into the superannuation system Labor has lumbered us with.

Source: Australian Tax Office[1]

It’s urgent because compulsory super contributions are scheduled to climb from the current 9.5% of salary to 12%, beginning with an increase of 0.5% in July 2021[2], followed by an extra 0.5% in 2022, 2023, 2024 and 2025.

If that seems rapid, and painful, it is because it is due to happen at twice the rate it has been[3].

Under the schedule imposed by Labor when it was last in office compulsory contributions were to climb by 0.25% of salary in each of 2013 and 2014 and then at twice the rate, by 0.5%, in each of the five years after that.

Compulsory super is set to jump..

The Coalition hit pause after 2014 just before the rate accelerated, postponing the series of five much bigger increases until 2022, when it might have hoped that wage growth would be robust enough to cope with it, or when it would have been someone else’s problem.

Labor says it will stick to that schedule, presumably regardless of wage growth or other economic conditions or the need for extra super contributions at the time.

Asked, ahead of the release of the Productivity Commission’s report on how to make super funds more efficient, whether Labor would reconsider the schedule if the Commission found other ways to boost retirement incomes, Labor Treasury spokesman Chris Bowen said it would not.

It’s almost as if – to Labor – lifting compulsory super contributions has the status of a holy writ; perhaps because it would “complete the work” of Labor elder statesman Paul Keating who introduced compulsory super, or perhaps because so many union officials are tied up with the running of the funds that would benefit from the schedule of increases.

In the event the Productivity Commission report released on January 10 found ways to massively lift retirement incomes without lifting super contributions[4].

…whether we need it or not

It found unintended multiple accounts and the defaulting of new workers into entrenched underperforming funds were costing members an astonishing A$3.8 billion per year.

Weeding out the chronic underperformers, clamping down on unwanted multiple accounts and insurance policies, and letting workers choose funds from a short menu of good ones and stay in them for life would give the typical worker entering the workforce an extra A$533,000 in retirement.

Even a typical worker aged 55 today would get an extra A$79,000 in retirement.

What the Commission’s report couldn’t say, but stongly implied, was that if the Commission’s recommendations were adopted an increase in costly compulsory contributions might not be necessary.

Its terms of reference limited it to assessing the “efficiency and competitiveness” of what happened to the contributions that were collected.

Henry was unconvinced

Another inquiry – less hamstrung – was the Henry Tax Review. It found no need[5] to increase contributions. Labor treasurer Wayne Swan dishonoured its findings by announcing the proposed increase in contributions on May 2, 2010[6], the day he released its report.

But super wasn’t the main focus of the Henry Review. In the 25 year history of compulsory super, there has never been an inquiry into what the rate should be and what the system has achieved. It’s as if governments of both types have been keen to govern blindly.

So in January the Productivity Commission tentatively ventured beyond its brief, in a recommendation Treasurer Josh Frydenberg has promised to respond to before the election.

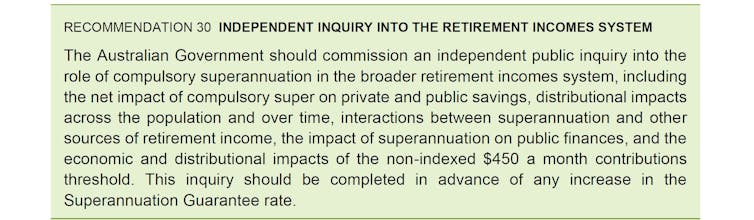

It is Recommendation 30[7], for an independent inquiry into the entire system.

Source: Australian Tax Office[1]

It’s urgent because compulsory super contributions are scheduled to climb from the current 9.5% of salary to 12%, beginning with an increase of 0.5% in July 2021[2], followed by an extra 0.5% in 2022, 2023, 2024 and 2025.

If that seems rapid, and painful, it is because it is due to happen at twice the rate it has been[3].

Under the schedule imposed by Labor when it was last in office compulsory contributions were to climb by 0.25% of salary in each of 2013 and 2014 and then at twice the rate, by 0.5%, in each of the five years after that.

Compulsory super is set to jump..

The Coalition hit pause after 2014 just before the rate accelerated, postponing the series of five much bigger increases until 2022, when it might have hoped that wage growth would be robust enough to cope with it, or when it would have been someone else’s problem.

Labor says it will stick to that schedule, presumably regardless of wage growth or other economic conditions or the need for extra super contributions at the time.

Asked, ahead of the release of the Productivity Commission’s report on how to make super funds more efficient, whether Labor would reconsider the schedule if the Commission found other ways to boost retirement incomes, Labor Treasury spokesman Chris Bowen said it would not.

It’s almost as if – to Labor – lifting compulsory super contributions has the status of a holy writ; perhaps because it would “complete the work” of Labor elder statesman Paul Keating who introduced compulsory super, or perhaps because so many union officials are tied up with the running of the funds that would benefit from the schedule of increases.

In the event the Productivity Commission report released on January 10 found ways to massively lift retirement incomes without lifting super contributions[4].

…whether we need it or not

It found unintended multiple accounts and the defaulting of new workers into entrenched underperforming funds were costing members an astonishing A$3.8 billion per year.

Weeding out the chronic underperformers, clamping down on unwanted multiple accounts and insurance policies, and letting workers choose funds from a short menu of good ones and stay in them for life would give the typical worker entering the workforce an extra A$533,000 in retirement.

Even a typical worker aged 55 today would get an extra A$79,000 in retirement.

What the Commission’s report couldn’t say, but stongly implied, was that if the Commission’s recommendations were adopted an increase in costly compulsory contributions might not be necessary.

Its terms of reference limited it to assessing the “efficiency and competitiveness” of what happened to the contributions that were collected.

Henry was unconvinced

Another inquiry – less hamstrung – was the Henry Tax Review. It found no need[5] to increase contributions. Labor treasurer Wayne Swan dishonoured its findings by announcing the proposed increase in contributions on May 2, 2010[6], the day he released its report.

But super wasn’t the main focus of the Henry Review. In the 25 year history of compulsory super, there has never been an inquiry into what the rate should be and what the system has achieved. It’s as if governments of both types have been keen to govern blindly.

So in January the Productivity Commission tentatively ventured beyond its brief, in a recommendation Treasurer Josh Frydenberg has promised to respond to before the election.

It is Recommendation 30[7], for an independent inquiry into the entire system.

The independent inquiry would determine whether or not the system we’ve had for the past 25 years has boosted national or even private savings rates, as well as who it has hurt and who it has helped.

They are the type of questions you would think a government would want to answer before lifting compulsory contributions further from 9.5% of salary to 12%.

Frydenberg could show leadership…

Indeed, Recommendation 30 explicitly asks that the inquiry “be completed in advance of any increase in the superannuation guarantee rate”.

It is possible to guess what the inquiry would find:

that almost all increases in employers’ compulsory super contributions come out of what would have been wages, depressing workers take home pay, a finding that will not be seriously disputed[8]

that the system hasn’t boosted national savings - the increase in private savings has been offset by the decrease in government savings brought about by the use of the super tax concessions

that the increase in private savings has come almost entirely from the middle to low earners who have been unable to escape the impact of the levy, because they have had no other savings they could cut. They are the people who could least afford to save more at the time they were forced to

the tax benefits have gone overwhelming to the high earners who are saving no more than they would have without them, and without compulsion

In sum, the inquiry is likely to find that the system is regressive and cruel. Or perhaps not. We won’t know until it is held.

It ought to be conducted by an expert panel whose members are highly respected and who will amass evidence the next government won’t be able to ignore.

…ensuring Labor does more than look after mates

Frydenberg ought to appoint the panel now, or within weeks, so that an incoming Labor government can’t dismantle it.

It would be one of his most important legacies. And would give him something to press the next government about should he be in opposition.

In time an incoming Labor government might thank him.

At present, without the scheduled increases in compulsory super, wage growth is just 2.3%. With the scheduled increases of 0.5 percentage points per year, wage growth might fall below the rate of inflation, for five consecutive years.

No sensible treasurer would allow that happen. By doing what’s right, Frydenberg might be giving Bowen an out.

Read more:

Productivity Commission finds super a bad deal. And yes, it comes out of wages[9]

The independent inquiry would determine whether or not the system we’ve had for the past 25 years has boosted national or even private savings rates, as well as who it has hurt and who it has helped.

They are the type of questions you would think a government would want to answer before lifting compulsory contributions further from 9.5% of salary to 12%.

Frydenberg could show leadership…

Indeed, Recommendation 30 explicitly asks that the inquiry “be completed in advance of any increase in the superannuation guarantee rate”.

It is possible to guess what the inquiry would find:

that almost all increases in employers’ compulsory super contributions come out of what would have been wages, depressing workers take home pay, a finding that will not be seriously disputed[8]

that the system hasn’t boosted national savings - the increase in private savings has been offset by the decrease in government savings brought about by the use of the super tax concessions

that the increase in private savings has come almost entirely from the middle to low earners who have been unable to escape the impact of the levy, because they have had no other savings they could cut. They are the people who could least afford to save more at the time they were forced to

the tax benefits have gone overwhelming to the high earners who are saving no more than they would have without them, and without compulsion

In sum, the inquiry is likely to find that the system is regressive and cruel. Or perhaps not. We won’t know until it is held.

It ought to be conducted by an expert panel whose members are highly respected and who will amass evidence the next government won’t be able to ignore.

…ensuring Labor does more than look after mates

Frydenberg ought to appoint the panel now, or within weeks, so that an incoming Labor government can’t dismantle it.

It would be one of his most important legacies. And would give him something to press the next government about should he be in opposition.

In time an incoming Labor government might thank him.

At present, without the scheduled increases in compulsory super, wage growth is just 2.3%. With the scheduled increases of 0.5 percentage points per year, wage growth might fall below the rate of inflation, for five consecutive years.

No sensible treasurer would allow that happen. By doing what’s right, Frydenberg might be giving Bowen an out.

Read more:

Productivity Commission finds super a bad deal. And yes, it comes out of wages[9]

References

- ^ Source: Australian Tax Office (www.ato.gov.au)

- ^ 0.5% in July 2021 (www.superguide.com.au)

- ^ twice the rate it has been (www.superguide.com.au)

- ^ without lifting super contributions (www.pc.gov.au)

- ^ found no need (taxreview.treasury.gov.au)

- ^ May 2, 2010 (www.scribd.com)

- ^ Recommendation 30 (www.pc.gov.au)

- ^ will not be seriously disputed (theconversation.com)

- ^ Productivity Commission finds super a bad deal. And yes, it comes out of wages (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University