Superannuation trustees should find long-term assets for their pensioners

- Written by Anthony Asher, Associate Professor, UNSW

The Financial Services Royal Commission[1] spent the last couple of weeks uncovering misconduct[2] in the superannuation industry. But as we clean up superannuation we should also fix another deficiency – the need to provide life-long incomes for retirees.

A recent survey[3] found a third of Australians over 80 had run out of money. The rest want reliable life-long incomes. Funnily enough, there are many projects that need funds and can produce cash flows for decades – infrastructure particularly.

Superannuation funds are increasingly making infrastructure investments themselves[4]. What is needed is a way to link the long-term cash flows derived from physical assets straight through to pensioners.

Investment markets are currently too conflicted to do so.

The status quo

Companies, and even governments entering long term projects mainly use short-to-medium-term bank loans to fund their activities. These loans must be refinanced regularly.

For reasons that the Financial Systems Inquiry[5] could not explain, companies often borrow overseas and so are subject not just to the risk of changing interest rates, but also to fluctuating foreign exchange rates.

To reduce these risks they may enter into sophisticated hedging programs[6], but this only serves to move risk elsewhere in the financial sector.

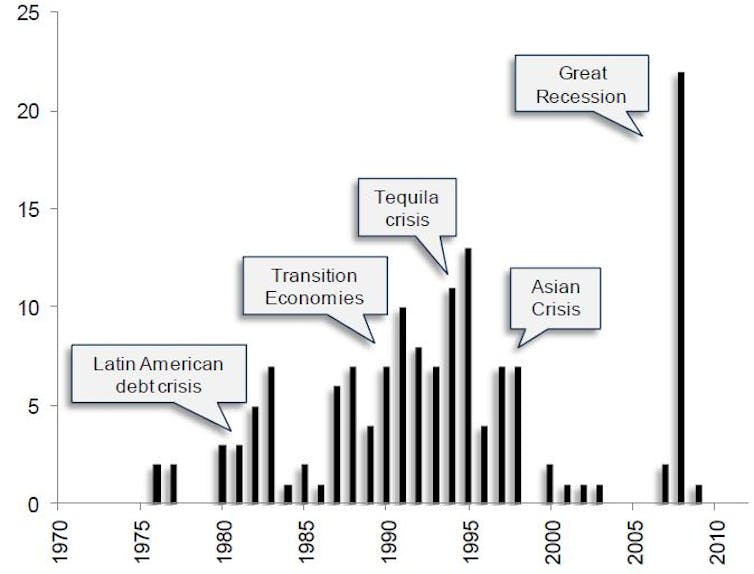

Banks, which provide short term finance for long term projects, suffer regular liquidity[7] crises when depositors want to withdraw their money. An IMF report[8] records 129 crises in the 40 years before 2010.

Banking crises.

Banking crises.

At the same time, about 70%[9] of superannuation benefits are taken as “account-based pensions[10]” – regular income streams that the pensioners draw down to pay their expenses.

This money has been invested in thousands of investment options, all of which provide liquidity so that pensioners can sell assets at any time.

But if the money is taken as regular monthly income, all of this liquidity is unnecessary – the funds could have been invested in something that produces monthly cash flows.

The alternative

Consider, for instance, a large infrastructure project that will generate revenue over 50 years, increasing over time more or less in line with inflation.

One could design[11] a financial instrument that paid investors a fixed proportion of that revenue. If the investors were superannuation funds, they could issue annuity contracts that paid out these cash flows to pensioners for life.

The borrowers would face lower risks, as their repayments move together with their revenue. Both borrowers and investors would be unaffected by changes to interest rates or the market value of investments.

Read more: How superannuation discriminates against middle income earners[12]

Why hasn’t this already been done? It is not that the cash flows from long-term investments are insufficient. They currently exceed all private and public pensions[13].

These kinds of financial instruments are already used[14] on a very small scale in Australia.

The major obstacle to their wider use seems to be that the financial sector feeds off the excess liquidity[15] in the market. Banks make money by rolling over short-term loans. Investment managers, stockbrokers and exchanges make money by trading superannuation assets.

The whole sector operates under a paradigm where liquidity is paramount. So they fail to address the risks this presents to banks, economies and to retirees.

It is not that people do not like these “life annuities[16]” when they are explained appropriately[17], but that their advisers and other experts active in the financial sector at best ignore them and at worst actively discourage them (by emphasising the “need” for liquidity).

Read more: Wealth inequality shows superannuation changes are overdue[18]

The ongoing problems of the financial sector must surely make us ask whether it is fit for purpose? Or, at least, how well is it fulfilling its functions[19] of allocating capital and managing risks?

We need appropriate pipes to ensure the cash generated by long-term assets flows through to fund pensioners. What we have instead is a flood of liquidity, which regularly buffets not only the financial sector but the entire economy.

The impetus to fund both long-term projects and life-long pensions must ultimately come from superannuation fund trustees. They appoint those who select assets and must set up the systems to ensure the cash flows are paid to pensioners.

To do this, they must first free themselves from the paradigm that liquidity is paramount. They then need to employ people and consultants whose loyalty is to the members and not the investment markets.

They will have to set up structures to be able to evaluate the soundness of new projects, and secondary markets to allow for trading as necessary. Government and regulators will have to permit funds to collaborate in this process.

Trustees will also need to take the lead and give members access to annuity products, and disinterested and expert advice as to when these are suitable.

References

- ^ Financial Services Royal Commission (financialservices.royalcommission.gov.au)

- ^ uncovering misconduct (theconversation.com)

- ^ recent survey (nationalseniors.com.au)

- ^ making infrastructure investments themselves (infrastructure.org.au)

- ^ Financial Systems Inquiry (fsi.gov.au)

- ^ sophisticated hedging programs (www.investopedia.com)

- ^ liquidity (www.investopedia.com)

- ^ IMF report (www.imf.org)

- ^ about 70% (www.apra.gov.au)

- ^ account-based pensions (www.moneysmart.gov.au)

- ^ One could design (mckellinstitute.org.au)

- ^ How superannuation discriminates against middle income earners (theconversation.com)

- ^ exceed all private and public pensions (mckellinstitute.org.au)

- ^ are already used (thewire.fiig.com.au)

- ^ the financial sector feeds off the excess liquidity (pubs.aeaweb.org)

- ^ life annuities (www.investopedia.com)

- ^ explained appropriately (www.jstor.org)

- ^ Wealth inequality shows superannuation changes are overdue (theconversation.com)

- ^ functions (www.researchgate.net)

Authors: Anthony Asher, Associate Professor, UNSW