As petrol prices rise, will carbon emissions come down?

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

No one likes paying A$1.80[1] per litre for petrol. But amid forecasts of prices climbing to $2.10[2] as Russian’s invasion of Ukraine drags on, it’s possible some good could come of that pain – including greater energy independence and a faster path to net-zero emissions.

Two months ago, at the start of 2022, the typical Sydney and Melbourne unleaded price was $1.60[3] a litre. A year earlier, at the start of 2021, it was $1.20[4].

That increase – from $1.20 to $1.80 in just 14 months – is a jump of 50%.

Estimates of the price elasticity of demand for petrol[5] prepared by Paul Burke of the Australian National University and Shuhei Nishitateno of Kwansei Gakuin University in Japan come up with the number 0.3. Other estimates are higher[6].

A price elasticity of 0.3 means that for each 10% a price climbs, demand for the product falls 3%.

In the case of petrol, where the price has climbed a phenomenal 50% in the past 14 months, demand for it should fall 15%, a fall big enough to make a dent[7] in Australia’s greenhouse gas emissions.

There’s been nothing like such a drop, and what drop there has been can be explained by COVID measures[8] such as lockdowns and working from home.

The high price needs to last to have an effect

There hasn’t been a big drop because the elasticity estimates are long term. Those of us who drive cars don’t (and often can’t) react straight away.

Sure, we can delay filling up if the price is high, or drive from one station to another, but in the short term we have no choice but to buy petrol.

Longer term, if we think the price is going to stay high, we will change our behaviour. Burke and Nishitateno’s calculations suggest that each 10% increase in the price of petrol that lasts boosts the average fuel efficiency of new cars by 2%.

It’s an average figure. Some of us will go electric altogether, and be freed of petrol bills, others will do nothing, and others will buy smaller cars or hybrids.

Petrol prices change what we buy

This is how things have played out. When prices shot up in the 1970s we switched to smaller cars[9], most of which weren’t made in Australia, and helped trigger the decline of the Australian car industry. When prices fell after a spike around 2008 we moved to gas-guzzling SUVs[10].

So what will matter for our demand for petrol (and our emissions) is whether the higher prices last. There’s no doubt we are paying attention.

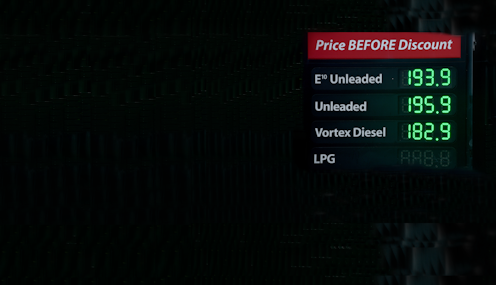

We spend almost as much on alcohol (2.2% of our budgets) as we do on petrol (2.6%[11]) but we notice petrol prices more. In part this because they are displayed prominently in well-lit letters of a regulated height.

As marketing researcher David Chalke[12] put it, “you have to buy it, and there’s a bloody great big sign always there telling you how much it is”.

In the 1970s and early 1980s, Australia was fairly self-sufficient[13] in petrol. There was a lot of oil in the Bass Strait[14] and Australia refined it locally.

Then the wells ran low. These days 60% of our petrol is imported and most of the 40% that is made here is made from imported oil[15].

Russia is one the big three suppliers

It means our prices move with international prices, which are determined by how much is needed (COVID and the rise of China have big effects) and how much is supplied.

Supply is partly determined by big oil exporting nations that get together and strike agreements with the aim of keeping prices high, but not so high that buyers buy less. The biggest are Saudi Arabia[16] (17% of exported crude oil), Russia (11%) and Iraq (7.7%).

From time to time they break these agreements, as Russia[17] seemed to in 2009 when it sent far more oil into the market than was expected and helped bring about the biggest price collapse on record, pushing down the price from US$140 per barrel to US$40 per barrel, and helping usher in the era of the SUV.

Australian prices are low

Australian petrol prices are at record highs, but by international standards they are still unusually low; the fourth-lowest among the 33 OECD nations graphed by Australia’s Bureau of Resource & Energy Economics – above only Turkey, the United States and Columbia.

The chief reason is tax, In December taxes (fuel excise plus GST) accounted for only 37%[18] of the price of Australian unleaded petrol, compared to 48% of New Zealand petrol and 60% of German and UK petrol.

Low by international standards

There are good reasons for taxing Australian motorists more. Higher taxes would better reflect the cost of roads and road repair and the environmental damage wrought by cars.

That’s not likely to happen right now – although in 2014[20] the Coalition reintroduced indexation in the face of surprising opposition from the Greens, ensuring fuel tax at least increased in line with prices. But it suggests there’s little room to cut taxes.

Read more: What Russia's war means for Australian petrol prices: $2.10 a litre[21]

If access to Russian oil remains difficult and prices don’t return to where they were, we will move away from using petrol faster, either by making adjustments such as working more from home or by buying cars that are more efficient or more electric.

It’ll be a bizarre and largely welcome byproduct of war in Ukraine, perhaps the only welcome one. It’ll increase the value of takeover target AGL[22], Australia’s largest electricity supplier, and speed us on our path to zero emissions and energy independence. It’ll get us where we are going sooner.

References

- ^ A$1.80 (www.aip.com.au)

- ^ $2.10 (theconversation.com)

- ^ $1.60 (www.aip.com.au)

- ^ $1.20 (www.accc.gov.au)

- ^ price elasticity of demand for petrol (openresearch-repository.anu.edu.au)

- ^ higher (www.researchgate.net)

- ^ dent (www.climatecouncil.org.au)

- ^ COVID measures (cdn-api.markitdigital.com)

- ^ smaller cars (www.rba.gov.au)

- ^ gas-guzzling SUVs (theconversation.com)

- ^ 2.6% (www.abs.gov.au)

- ^ David Chalke (www.smh.com.au)

- ^ fairly self-sufficient (www.nytimes.com)

- ^ Bass Strait (theconversation.com)

- ^ imported oil (www.aph.gov.au)

- ^ Saudi Arabia (www.worldstopexports.com)

- ^ Russia (www.oxfordenergy.org)

- ^ 37% (www.energy.gov.au)

- ^ Department of Industry, Science, Energy and Resources (www.energy.gov.au)

- ^ 2014 (www.financeminister.gov.au)

- ^ What Russia's war means for Australian petrol prices: $2.10 a litre (theconversation.com)

- ^ takeover target AGL (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Read more https://theconversation.com/as-petrol-prices-rise-will-carbon-emissions-come-down-178024