China Logistics Leasing Demand Remained Stable In H1 2023

- Written by The Bulletin

Tony Su, Managing Director, National Head of Industrial & Logistics Property Services, China, Cushman & Wakefield, said: "Overall logistics market leasing demand remained stable in H1 2023. In terms of logistics leasing demand by sector, the manufacturing and consumer sectors contributed much to take up. E-commerce and third-party logistics enterprises remain the main tenants within the premium warehouse leasing market."

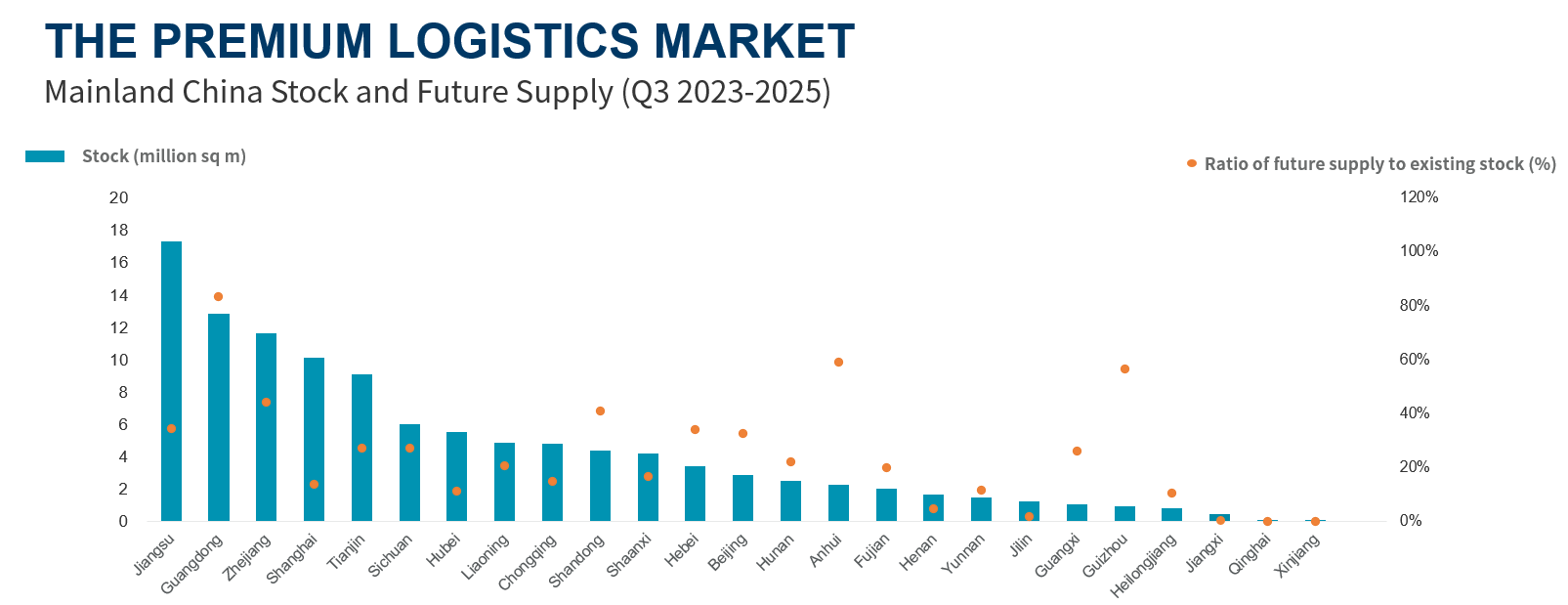

Jiangsu, Guangdong and Zhejiang were the top three locations for total stock in H1, with each market also slated for a large volume of scheduled future supply in the next two years, which will bring some leasing pressure. But due to the well-developed regional industry and strong demand for premium logistics warehouses, new projects will be effectively leased. With the tight supply of warehousing land, the premium logistics warehouse market is expected to exhibit a positive development trend during the long term.

Mainland China Logistics Market

- The total stock of premium logistics warehouse space in mainland China reached 114 million sq m in H1 2023.

- Approximately 5.02 million sq m of new supply entered the mainland China logistics market in H1.

- The overall vacancy rate increased 1.4 percentage points from Q4 2022 to 16.5%.

- Overall average rents rose 0.8% from Q4 2022 to RMB33.8 per sq m per month.

- Ahead, an additional 37.98 million sq m of new supply is scheduled for completion by the end of 2025.

The premium warehouse market in North China recorded several new projects completing in H1, totaling approximately 1.56 million sq m of new space. Average monthly rent increased 0.5% from Q4 2022 to reach RMB30.5 per sq m. The vacancy rate for premium warehouses rose 0.6 percentage points to 19.3%.

East China Logistics Overview

The East China premium warehouse market performance was stable in H1. Compared with Q4 2022, overall average monthly rent rose 0.8% to reach RMB38.5 per sq m. The overall warehouse vacancy rate rose 3.5 percentage points to 15.3%. The e-commerce, 3PL and express delivery sectors remained the main tenants in the East China premium warehouse market.

South China & Central China Logistics Overview

The South China premium warehouse market experienced strong demand in H1. South China recorded 0.8 million sq m of new supply in H1. Compared with Q4 2022, the overall vacancy rate dropped 1.1 percentage points to 9.4% while the average monthly rent rose 1.6% to reach RMB40.4 per sq m. The Central China premium warehouse market remained relatively stable. Compared with Q4 2022, the overall vacancy rate dropped 0.3 percentage points to record 18.9%. Average monthly rent decreased slightly by 0.7% to RMB26.4 per sq m.

Southwest China Logistics Overview

Demand for premium warehouse space in Chongqing was stable, with the e-commerce, 3PL and manufacturing sectors being the key drivers. The average monthly rent rose slightly to reach RMB24.4 per sq m. Southwest China recorded 0.12 million sq m of new supply in H1. Compared with Q4 2022, the overall vacancy rate increased 1.8 percentage points to reach 20.4%. The average monthly rent rose 0.2% to reach RMB26.5 per sq m.

Hong Kong, China Logistics Overview

Hong Kong's total stock of premium logistics space remained at 31.2 million sq ft (2.90 million sq m) in H1, with no new supply recorded in the period. A mega-project totaling 4.1 million sq ft (0.38 million sq m) near the Hong Kong International Airport is expected to enter the market in H2 2023. Ahead, a new warehouse project is expected to be completed in Kwai Chung (New Territories) by 2027. Jointly developed by ESR and Chinachem, the project is expected to span 1.5 million sq ft (0.14 million sq m). The overall vacancy rate remained stable at 3.4%, while monthly rents increased mildly by 0.5% in H1 2023 to HK$14.4 per sq ft.

Taiwan, China Logistics Overview

Total premium logistics stock increased to approximately 989,000 pings (3.27 million sq m).

Incoming supply is expected to add 186,000 pings (615,000 sq m) of stock by the close of 2025, an increase of approximately 18.8%. Around 78% of stock is concentrated in Taoyuan City, close to Taoyuan International Airport. The average monthly rental level remained at approximately NT$650–750 per ping.

Shaun Brodie, Head of Business Development Services, East China & Greater China Research Content, Head of Greater China Occupier Research, Cushman & Wakefield, added: "Ahead, we expect the government and landlords to favor tenants with higher business efficiency and production volume. With the change in consumers' consumption preferences and, subsequently, the demand structure, the development of the semi-prepared food market will further promote expansion in the cold chain logistics and storage market. The development of comprehensive cold chain parks, integrating production, storage, display, and sales functions, will become an emerging market trend."

Please click here to download the full report.

Hashtag: #Cushman&Wakefield

The issuer is solely responsible for the content of this announcement.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in approximately 400 offices and 60 countries. In Greater China, a network of 23 offices serves local markets across the region. In 2022, the firm reported global revenue of US$10.1 billion across its core services of valuation, consulting, project & development services, capital markets, project & occupier services, industrial & logistics, retail and others. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), Environmental, Social and Governance (ESG) and more. For additional information, visit www.cushmanwakefield.com.