Please, no more questions about how we are going to pay off the COVID debt

- Written by Steven Hail, Lecturer in Economics, University of Adelaide

There are many uncertainties about the next federal election, but there is one thing about which you can be almost completely certain. It is the response that both the Prime Minister and the Leader of the Opposition will give when asked this question:

How are we going to pay off our COVID-19 debt?

Scott Morrison and Anthony Albanese disagree on a great many things, but in their answer they will be in perfect harmony.

It will be: “we will need to pay it back in the future by spending less or taxing more — otherwise, we might lack the means to deal with a future crisis”.

They might even talk about “fiscal firepower” — the need to up a budget surplus in order to have something to spend the next time there’s an emergency.

The strange thing is that although this is for them the safest answer to give, and although it is the conventional wisdom, it simply isn’t true.

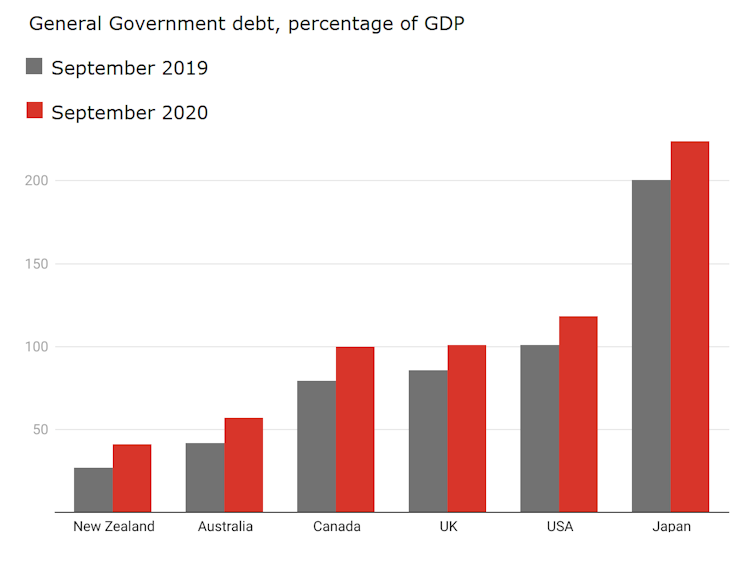

Consider the following chart. It shows the general government debt as a share of gross domestic product in six countries with similar monetary systems to Australia’s, just prior to the pandemic, and then a year later.

Bank for International Settlements

You cannot help but notice that four of the other five countries had more general government debt than Australia before the COVID crisis, and Japan’s national government had four times as much government debt as Australia.

It made no difference to their ability to spend as needed to support their economies during the pandemic, none whatsoever.

Debt hasn’t hamstrung responses to the crisis

This means it’s wrong to suggest that our government wouldn’t be able to support its economy, even if it didn’t pay back its COVID-related debt.

You might imagine (it’s been said) that more government debt would drive up interest rates, but of late that hasn’t been the case either.

Indeed, the rate of interest on 10-year Japanese government bonds has been close to zero for five years, because it has been held there by the Bank of Japan.

Or perhaps you think that more government debt will lead to higher inflation. In Japan and elsewhere that hasn’t happened either. Japan has had the lowest average inflation rate of these six countries.

And so far it hasn’t stoked inflation

So many myths.

The pivot the Coalition is taking to winding back spending with the end of JobKeeper and the withdrawal of a liveable JobSeeker payment isn’t needed, and is also unwise.

The reluctance of the Labor Party to support a non-poverty unemployment benefit, and its promise to avoid net spending commitments in its election platform, are also unjustified.

Especially in an economy where labour force underutilisation (unemployment plus underemployment) remains over 14%. Nearly two million people are either unemployed or underemployed.

Read more:

Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment[1]

Many more are in insecure employment, including hundreds of thousands whose jobs are now at risk because of the failure to replace JobKeeper with something such as with a federal job guarantee.

It isn’t as though the Australian Greens are speaking from a fiscal script which is that different. The Greens obsess over costing their policies and finding extra tax from resource companies and billionaires to “pay for” their commitments to full employment, social security, education, healthcare, and investment in renewables.

They may not talk so much about repaying the debt, but they do not want to be accused of adding to it.

The Greens worry like the others

Like the bigger parties, the Greens are reluctant to challenge the narrative of the federal government as a household, with a budget it must manage in order to avoid insolvency.

But the household metaphor is another myth, and it needs to be challenged.

The federal government’s finances have nothing in common with those of a household, however wealthy that household might be, and nothing in common with any business, big or small, or even state and territory governments.

None of these are currency issuers. They have to generate income or borrow before they can spend, and their borrowing puts them at risk of insolvency.

Read more:

Australia’s credit rating is irrelevant. Ignore it[2]

Our federal government is different, like the national governments of Japan and the United States. It is the monopoly issuer of the Australian-dollar-denominated currency.

The government does not need to increase taxes in order to increase spending, and it doesn’t even need to borrow. Its Reserve Bank issues currency for it all of the time, every day.

Federal government spending is funded when it is authorised, usually by parliament.

Having spent its currency into existence, the government usually offers savers the opportunity to convert that currency into treasury bonds, which usually offer a better rate of interest than transaction accounts with a bank.

Read more:

We've just sold $15 billion 31-year bonds. What's a bond?[3]

Our government chooses to sell treasury bonds - it doesn’t need to.

This means it can’t be held hostage by the bond market. It can’t be forced into insolvency or austerity. The selling of bonds doesn’t constitute borrowing in the normal sense of the term. It is better described as a way of winding back the money supply.

At the end of the life of the bond (when the “loan” comes due) it can pay it off (swapping cash for the bond). Or it can issue a replacement bond if it doesn’t want to inject more money into the economy.

It’s not just me saying that. It is also a senior economist with the US Federal Reserve, David Andolfatto, in December in a paper[4] published by the St Louis Fed.

Together these considerations suggest we might want to look at the national debt from a different perspective. In particular, it seems more accurate to view the national debt less as a form of debt and more as a form of money in circulation.

President Biden is listening to voices like Andolfatto’s. Australian politicians are not. Ours continue to see federal deficits as a burden on future generations, when they are not that at all – they supply financial resources to the present generation.

The national debt is nothing more than the dollars the government has put into the economy and not yet taxed back out. Deficits matter, but not the way Albanese and Morrison seem to imagine. They matter because if they get too big, they might stoke too much inflation.

What if our leaders spoke the truth

In an economy with spare capacity (unemployment and underemployment) and with wage setting institutions that make it difficult to argue that there will be significant persistent inflation in the foreseeable future, there is no reason at the moment to wind back spending, not until unemployment and underemployment are much lower.

For the Greens, there is no need for them to tie themselves in knots, arguing on the one hand that they need to shrink coal mining to address climate change and on the other that they need to raise taxes from the mining industry to pay for government services.

Taxes collected from the mining and other industries (and form individuals) don’t fund federal government spending. It is self-funded. And the limits on spending are not imposed by tax receipts and the ability of the government to borrow. They are imposed by the availability of productive capacity in our economy and our ability to use that capacity without stoking inflation.

Read more:

Bernie Sanders' economic adviser has a message we might just need[5]

When our leaders are next asked, “how are we going to pay off our COVID-19 debt”, they ought to take a deep breath, look the interviewer in the eyes, and say “we don’t need to, because it is not debt in the conventional sense of the term”.

They ought to tell the public the truth. It’s a novel idea, perhaps, but it would lead to a better educated public and a fairer and better-managed economy.

Bank for International Settlements

You cannot help but notice that four of the other five countries had more general government debt than Australia before the COVID crisis, and Japan’s national government had four times as much government debt as Australia.

It made no difference to their ability to spend as needed to support their economies during the pandemic, none whatsoever.

Debt hasn’t hamstrung responses to the crisis

This means it’s wrong to suggest that our government wouldn’t be able to support its economy, even if it didn’t pay back its COVID-related debt.

You might imagine (it’s been said) that more government debt would drive up interest rates, but of late that hasn’t been the case either.

Indeed, the rate of interest on 10-year Japanese government bonds has been close to zero for five years, because it has been held there by the Bank of Japan.

Or perhaps you think that more government debt will lead to higher inflation. In Japan and elsewhere that hasn’t happened either. Japan has had the lowest average inflation rate of these six countries.

And so far it hasn’t stoked inflation

So many myths.

The pivot the Coalition is taking to winding back spending with the end of JobKeeper and the withdrawal of a liveable JobSeeker payment isn’t needed, and is also unwise.

The reluctance of the Labor Party to support a non-poverty unemployment benefit, and its promise to avoid net spending commitments in its election platform, are also unjustified.

Especially in an economy where labour force underutilisation (unemployment plus underemployment) remains over 14%. Nearly two million people are either unemployed or underemployed.

Read more:

Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment[1]

Many more are in insecure employment, including hundreds of thousands whose jobs are now at risk because of the failure to replace JobKeeper with something such as with a federal job guarantee.

It isn’t as though the Australian Greens are speaking from a fiscal script which is that different. The Greens obsess over costing their policies and finding extra tax from resource companies and billionaires to “pay for” their commitments to full employment, social security, education, healthcare, and investment in renewables.

They may not talk so much about repaying the debt, but they do not want to be accused of adding to it.

The Greens worry like the others

Like the bigger parties, the Greens are reluctant to challenge the narrative of the federal government as a household, with a budget it must manage in order to avoid insolvency.

But the household metaphor is another myth, and it needs to be challenged.

The federal government’s finances have nothing in common with those of a household, however wealthy that household might be, and nothing in common with any business, big or small, or even state and territory governments.

None of these are currency issuers. They have to generate income or borrow before they can spend, and their borrowing puts them at risk of insolvency.

Read more:

Australia’s credit rating is irrelevant. Ignore it[2]

Our federal government is different, like the national governments of Japan and the United States. It is the monopoly issuer of the Australian-dollar-denominated currency.

The government does not need to increase taxes in order to increase spending, and it doesn’t even need to borrow. Its Reserve Bank issues currency for it all of the time, every day.

Federal government spending is funded when it is authorised, usually by parliament.

Having spent its currency into existence, the government usually offers savers the opportunity to convert that currency into treasury bonds, which usually offer a better rate of interest than transaction accounts with a bank.

Read more:

We've just sold $15 billion 31-year bonds. What's a bond?[3]

Our government chooses to sell treasury bonds - it doesn’t need to.

This means it can’t be held hostage by the bond market. It can’t be forced into insolvency or austerity. The selling of bonds doesn’t constitute borrowing in the normal sense of the term. It is better described as a way of winding back the money supply.

At the end of the life of the bond (when the “loan” comes due) it can pay it off (swapping cash for the bond). Or it can issue a replacement bond if it doesn’t want to inject more money into the economy.

It’s not just me saying that. It is also a senior economist with the US Federal Reserve, David Andolfatto, in December in a paper[4] published by the St Louis Fed.

Together these considerations suggest we might want to look at the national debt from a different perspective. In particular, it seems more accurate to view the national debt less as a form of debt and more as a form of money in circulation.

President Biden is listening to voices like Andolfatto’s. Australian politicians are not. Ours continue to see federal deficits as a burden on future generations, when they are not that at all – they supply financial resources to the present generation.

The national debt is nothing more than the dollars the government has put into the economy and not yet taxed back out. Deficits matter, but not the way Albanese and Morrison seem to imagine. They matter because if they get too big, they might stoke too much inflation.

What if our leaders spoke the truth

In an economy with spare capacity (unemployment and underemployment) and with wage setting institutions that make it difficult to argue that there will be significant persistent inflation in the foreseeable future, there is no reason at the moment to wind back spending, not until unemployment and underemployment are much lower.

For the Greens, there is no need for them to tie themselves in knots, arguing on the one hand that they need to shrink coal mining to address climate change and on the other that they need to raise taxes from the mining industry to pay for government services.

Taxes collected from the mining and other industries (and form individuals) don’t fund federal government spending. It is self-funded. And the limits on spending are not imposed by tax receipts and the ability of the government to borrow. They are imposed by the availability of productive capacity in our economy and our ability to use that capacity without stoking inflation.

Read more:

Bernie Sanders' economic adviser has a message we might just need[5]

When our leaders are next asked, “how are we going to pay off our COVID-19 debt”, they ought to take a deep breath, look the interviewer in the eyes, and say “we don’t need to, because it is not debt in the conventional sense of the term”.

They ought to tell the public the truth. It’s a novel idea, perhaps, but it would lead to a better educated public and a fairer and better-managed economy.

References

- ^ Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment (theconversation.com)

- ^ Australia’s credit rating is irrelevant. Ignore it (theconversation.com)

- ^ We've just sold $15 billion 31-year bonds. What's a bond? (theconversation.com)

- ^ paper (www.stlouisfed.org)

- ^ Bernie Sanders' economic adviser has a message we might just need (theconversation.com)

Authors: Steven Hail, Lecturer in Economics, University of Adelaide