Frydenberg up to Bowen's old tricks

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

Chris Bowen has unpleasantly vivid memories, from when he was treasurer during the 2013 election campaign, of attributing costings of opposition policy to the public service.

Bowen, at a joint news conference with Kevin Rudd and Penny Wong, claimed a $10 billion hole in Coalition savings, citing advice from Treasury, Finance and the Parliamentary Budget Office. Within hours they’d been rebuked by the heads of all three, who called out the government’s misuse of their material.

All these years later, Treasurer Josh Frydenberg has failed to learn from Bowen’s mistake. He has misused and verballed his department, and been caught out.

On Friday Bowen complained to the head of Treasury Phil Gaetjens and the secretary of the Prime Minister’s department Martin Parkinson about the government’s use of Treasury costings to claim Labor would impose a $387 billion tax burden over ten years.

The claim is based on adding the $230 billion cost of the second and third stages of the government’s income tax package – which have been rejected by the opposition - to the ALP’s announced tax hikes from its planned changes to negative gearing, franking credits arrangements, etc.

“Treasury costings indicate that Labor’s tax hit on the economy has almost doubled from their initial costings of around $200 billion to $387 billion,” Treasurer Josh Frydenberg trumpeted in the government’s first massive “scare” strike of the campaign.

“This is equivalent to an extra yearly household tax bill of $5,400 within a decade.”

The income tax cuts were announced in last week’s budget but they are not yet legislated.

The program’s first stage has bipartisan support (though Labor would augment it for low income earners) and so can be considered settled policy.

The second and third stages are way into the future. Their cost is mostly outside the forward estimates.

Both stages are to start after the election following this one – that is due in the first half of 2022. Stage 2 is set be begin in 2022-23 and stage 3 in 2024-25.

Former Liberal treasurer Peter Costello last week was scathing about the practice of making tax promises stretching into the never never.

“We’ve stopped promising things for the year ahead, we’ve stopped promising things for the next term, we’ve stopped promising things for the term after the term, even. We’re promising things in the term after the term after the term,” Costello said.

“The tax scales in 2024 won’t be decided in this election. They’ll be decided in the election after it and the election after that.”

These stages may or may not come to pass if Scott Morrison is re-elected. There’s no guarantee they’d be accepted by the Senate - and no knowing what the government’s attitude would be if they weren’t.

Remember what occurred with the long-term tax cuts for big business included in the wider company tax cut package the Turnbull government unveiled in the 2016 pre-election budget.

It couldn’t win Senate approval for them, although deals were done to pass the cuts for small and medium sized companies. Finally, last year the government dropped its commitment to give relief to large companies.

The Coalition in this instance is guilty of a try on, to inflate the size of the target in its tax scare against the ALP.

This comes ahead of what will be many scares from both sides. The media and the voting public should regard them sceptically - just as people should have been sceptical of Labor’s Mediscare last time.

Treasury as recently as last week told Senate estimates that it doesn’t cost opposition policies. But this can be got around by the government having the department cost an “alternative” policy, a distinction without a difference.

When questioned on Friday, Frydenberg invoked the precedent of former treasurer Wayne Swan doing such things. It is not often the Liberals lean on “Swannie” as a crutch.

Looked at any which way this is a very unfortunate use of Treasury.

Of course the very basic calculation could have been done in Frydenberg’s office. But being able to say it was a “Treasury” number gives the scare a more authoritative stamp.

The idea is to suggest it is a non-political calculation – when the whole thing is very political.

Reportedly Treasury was also asked to do some costings on Labor’s climate change policy – another scare which is still in the pipeline.

It would be interesting to know if there was any private push back from Treasury about the government’s requests.

The incident just reinforces Labor’s view about the government’s politicisation of Treasury.

In Labor’s opinion this reached a peak with the appointment of Phil Gaetjens- Morrison’s chief-of-staff when he was treasurer – as secretary of the department.

Labor has already flagged that it would remove Gaetjens if it wins the election, if he didn’t resign first.

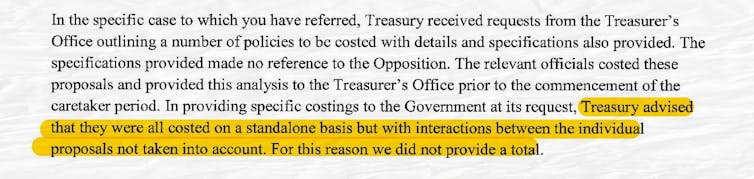

In response to the Bowen complaint, Gaetjens wrote back on Friday, saying Treasury had responded to requests before the “caretaker” period from the Treasurer’s office “outlining a number of policies to be costed with details and specifications also provided” - these “made no reference to the Opposition[1]”.

“We were not asked to cost another party’s policies and would not do so,” he wrote.

Extract from Treasury Secretary’s letter to Chris Bowen.

Commonwealth Treasury[2]

Extract from Treasury Secretary’s letter to Chris Bowen.

Commonwealth Treasury[2]

Treasury did the costings but did not take account of the interactions between the individual policies, so didn’t provide a total, Gaetjens said.

But Frydenberg did give a total – and attributed that total to Treasury.

Bowen seized on this to lambast the government, and promise a Labor one would restore Treasury “to its rightful place as the nation’s pre-eminent economic agency”.

Incidentally the tax costings row has a nice twist. One of those who put Bowen in his place in 2013 was Martin Parkinson, then secretary of Treasury, a recipients of a Bowen letter on Friday.

References

- ^ made no reference to the Opposition (www.treasury.gov.au)

- ^ Commonwealth Treasury (www.treasury.gov.au)

Authors: Michelle Grattan, Professorial Fellow, University of Canberra

Read more http://theconversation.com/view-from-the-hill-frydenberg-up-to-bowens-old-tricks-115382