What COVID-19 means for the people making your clothes

- Written by Sarah Kaine, Associate Professor UTS Centre for Business and Social Innovation, University of Technology Sydney

Workers everywhere are feeling the impact of COVID-19 and the restrictions necessitated by COVID-19.

In Australia, retail and hospitality[1] workers have been particularly hard hit. In other countries, it’s manufacturing[2] workers, hit by disruptions to value and supply chains.

A value chain[3] is the process by which businesses start with raw materials and add value to them through manufacturing and other processes to create a finished product.

A supply chain[4] is the steps taken to get a product to a consumer.

Most of the time we don’t think about them at all.

Cotton is complex

Our research project with the Cotton Research Development Corporation[5] is investigating strategies for improving labour conditions in the value chain for Australian cotton.

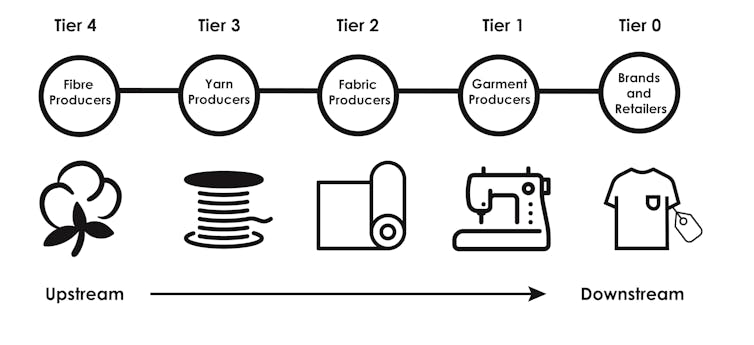

This is the chain in which our cotton is spun into yarn, woven or knitted into fabric, and turned into garments and other items which are sold to consumers.

When we began our project in mid-2019 the world was a very different place.

The changes brought by COVID-19 have had a significant impact on those working throughout the chain – particularly in garment production, but with flow on effects to other tiers.

Read more: The real economic victims of coronavirus are those we can't see[6]

The tiers in the diagram are numbered backwards.

The first is Tier 4, where Australian cotton is grown and harvested. The next is Tier 3 where it is turned into yarn, usually overseas.

Tier 2 is the production of fabric, Tier 1 is the production of garments and other products, and Tier 0 is retailing and selling to retailers.

Alice Payne Tier 0 (brands and retailers) has been hit by delays in shipments due to factory closures at Tiers 1 and 2. However this has been matched by a decline in demand as social distancing and lock-down arrangements discourage or prevent consumers from shopping in person. In Australia retailers such as Country Road[7], Cotton On[8] and RM William[9] temporarily closed, taking short-term retail job losses to 50,000 or more[10]. Globally, many multinationals have closed their doors. Shocks along the chain… Nike[11] is expecting sales to drop by US$3.5 billion. While seemingly immune from some of the social distancing provisions, online retail is also likely to take a hit due to a drop in demand. Tier 1 (garment manufacturing) has been hit by falling demand as retailers cancel orders or ask for delays in payment. It has also faced disruptions in the supply of fabric, especially from China. Read more: Human trafficking and slavery still happen in Australia. This comic explains how[12] Fabric producers in Tier 2 and cotton spinners in Tier 3 have had to contend with a decreased supply of raw materials and demands to retool to produce medical equipment. For cotton growers in Tier 4, the fall in demand has pushed prices down from US 70 cents at the start of the year to US 50 cents, the lowest price in a decade, before a partial recovery to US 58 cents. …with human costs Reports of losses of tens of thousands of jobs in Myanmar[13] and Cambodia[14] paint a bleak picture. In Bangladesh[15] estimates have 1.92 million workers at risk of losing their jobs as factories receive notice of US$2.58 billion worth of export orders cancelled or on-hold. Making things worse, many workers in Tiers 1-3 were receiving less than a living wage[16] defined as the minimum needed to provide adequate shelter, food and necessities. This has made it hard for them to plan or save for emergencies. Many are migrant workers[17] without funds to return home. Even the workers who manage to hang on to their jobs aren’t in the clear. Programs set up to improve their working conditions have been disrupted. Read more: Three years on from Rana Plaza disaster and little improvement in transparency or worker conditions[18] The Accord on Fire and Building Safety in Bangladesh[19] is a legally-binding agreement between brands and unions set up in the wake of the collapse of the the Rana Plaza factory in 2013 which killed 1,133 people and critically injuring thousands more. Inspections under the program have been suspended, as have audits[20] due to the closure of borders. The problems are cumulative – delays in orders due to interruptions in supplies will need to be addressed when factories scale back up, creating demands from buyers that might result in pressure for workers to work unpaid and involuntary overtime, or even worse, subcontract to the informal market[21] where there is a high risk of human rights violations. Shoots of hope Amid the havoc[22] are some shoots of hope. Companies along the value chain have been asked to produce and supply medical equipment such as surgical gowns, face masks and materials and elastics. Dozens of brands and retailers have donated funds[23] and activated their logistics networks to support the effort. As orders slowly start returning, cotton and textile associations have joined forces in calling for greater collaboration[24] throughout the value chain. Governments have announced aid packages[25] for their workers, and the European Union has provided an emergency fund[26] to support the most vulnerable garment workers in Myanmar. Longer term, the supply risks highlighted by the disruption might cause companies along the value chain to diversify their suppliers and even produce locally. Read more: It would cost you 20 cents more per T-shirt to pay an Indian worker a living wage[27] The crisis has demonstrated forcefully the importance for manufacturers and retailers to be agile. Yet this can best be done when workers have been well trained and have access to the best technology and equipment. For now, we watch and see. Cotton is as good an indicator as any other of the brittleness of supply chains and the ways in which what we produce and consume affects the livelihoods of those further down the chain. In the short-term, a best-case scenario would see a revaluing of garment work as “essential” in order to produce protective/medical equipment that we need in a way that benefits the people who help make them.

Alice Payne Tier 0 (brands and retailers) has been hit by delays in shipments due to factory closures at Tiers 1 and 2. However this has been matched by a decline in demand as social distancing and lock-down arrangements discourage or prevent consumers from shopping in person. In Australia retailers such as Country Road[7], Cotton On[8] and RM William[9] temporarily closed, taking short-term retail job losses to 50,000 or more[10]. Globally, many multinationals have closed their doors. Shocks along the chain… Nike[11] is expecting sales to drop by US$3.5 billion. While seemingly immune from some of the social distancing provisions, online retail is also likely to take a hit due to a drop in demand. Tier 1 (garment manufacturing) has been hit by falling demand as retailers cancel orders or ask for delays in payment. It has also faced disruptions in the supply of fabric, especially from China. Read more: Human trafficking and slavery still happen in Australia. This comic explains how[12] Fabric producers in Tier 2 and cotton spinners in Tier 3 have had to contend with a decreased supply of raw materials and demands to retool to produce medical equipment. For cotton growers in Tier 4, the fall in demand has pushed prices down from US 70 cents at the start of the year to US 50 cents, the lowest price in a decade, before a partial recovery to US 58 cents. …with human costs Reports of losses of tens of thousands of jobs in Myanmar[13] and Cambodia[14] paint a bleak picture. In Bangladesh[15] estimates have 1.92 million workers at risk of losing their jobs as factories receive notice of US$2.58 billion worth of export orders cancelled or on-hold. Making things worse, many workers in Tiers 1-3 were receiving less than a living wage[16] defined as the minimum needed to provide adequate shelter, food and necessities. This has made it hard for them to plan or save for emergencies. Many are migrant workers[17] without funds to return home. Even the workers who manage to hang on to their jobs aren’t in the clear. Programs set up to improve their working conditions have been disrupted. Read more: Three years on from Rana Plaza disaster and little improvement in transparency or worker conditions[18] The Accord on Fire and Building Safety in Bangladesh[19] is a legally-binding agreement between brands and unions set up in the wake of the collapse of the the Rana Plaza factory in 2013 which killed 1,133 people and critically injuring thousands more. Inspections under the program have been suspended, as have audits[20] due to the closure of borders. The problems are cumulative – delays in orders due to interruptions in supplies will need to be addressed when factories scale back up, creating demands from buyers that might result in pressure for workers to work unpaid and involuntary overtime, or even worse, subcontract to the informal market[21] where there is a high risk of human rights violations. Shoots of hope Amid the havoc[22] are some shoots of hope. Companies along the value chain have been asked to produce and supply medical equipment such as surgical gowns, face masks and materials and elastics. Dozens of brands and retailers have donated funds[23] and activated their logistics networks to support the effort. As orders slowly start returning, cotton and textile associations have joined forces in calling for greater collaboration[24] throughout the value chain. Governments have announced aid packages[25] for their workers, and the European Union has provided an emergency fund[26] to support the most vulnerable garment workers in Myanmar. Longer term, the supply risks highlighted by the disruption might cause companies along the value chain to diversify their suppliers and even produce locally. Read more: It would cost you 20 cents more per T-shirt to pay an Indian worker a living wage[27] The crisis has demonstrated forcefully the importance for manufacturers and retailers to be agile. Yet this can best be done when workers have been well trained and have access to the best technology and equipment. For now, we watch and see. Cotton is as good an indicator as any other of the brittleness of supply chains and the ways in which what we produce and consume affects the livelihoods of those further down the chain. In the short-term, a best-case scenario would see a revaluing of garment work as “essential” in order to produce protective/medical equipment that we need in a way that benefits the people who help make them. References

- ^ retail and hospitality (theconversation.com)

- ^ manufacturing (theconversation.com)

- ^ value chain (www.investopedia.com)

- ^ supply chain (www.investopedia.com)

- ^ Cotton Research Development Corporation (www.crdc.com.au)

- ^ The real economic victims of coronavirus are those we can't see (theconversation.com)

- ^ Country Road (www.countryroad.com.au)

- ^ Cotton On (cottonongroup.com.au)

- ^ RM William (www.rmwilliams.com.au)

- ^ 50,000 or more (www.afr.com)

- ^ Nike (www.businessoffashion.com)

- ^ Human trafficking and slavery still happen in Australia. This comic explains how (theconversation.com)

- ^ Myanmar (www.mmtimes.com)

- ^ Cambodia (english.cambodiadaily.com)

- ^ Bangladesh (sourcingjournal.com)

- ^ living wage (wageindicator.org)

- ^ migrant workers (digitalcommons.ilr.cornell.edu)

- ^ Three years on from Rana Plaza disaster and little improvement in transparency or worker conditions (theconversation.com)

- ^ Accord on Fire and Building Safety in Bangladesh (bangladeshaccord.org)

- ^ audits (www.sedexglobal.com)

- ^ subcontract to the informal market (www.hrw.org)

- ^ havoc (www.just-style.com)

- ^ donated funds (www.businessoffashion.com)

- ^ calling for greater collaboration (www.just-style.com)

- ^ aid packages (www.businessoffashion.com)

- ^ emergency fund (www.mmtimes.com)

- ^ It would cost you 20 cents more per T-shirt to pay an Indian worker a living wage (theconversation.com)

Authors: Sarah Kaine, Associate Professor UTS Centre for Business and Social Innovation, University of Technology Sydney

Read more https://theconversation.com/what-covid-19-means-for-the-people-making-your-clothes-134800