Want to boost Aboriginal financial capability? Spend time in communities

- Written by Jonathon Louth, Research Fellow, Australian Centre for Community Services Research, Flinders University

One of the key themes from the Banking Royal Commission’s trip to Darwin[1] was the rampant predatory practices of payday lenders and funeral insurers[2] who have targeted regional and remote Aboriginal communities. Our research [3] found many other examples of practices that placed Indigenous Australians at financial risk.

To take just one example: we interviewed a participant with an intermittent work history who borrowed A$18,000 for a car. They were then encouraged to top the loan up by an additional A$4,000. The interest rate on the loan was 35%. After falling into arrears the client entered into an arrangement to pay back the loan.

The final amount paid back? A$52,000. The car had long since stopped working.

While this predatory behaviour should be addressed, our study shows we need to shift our understanding of economic knowledge in remote communities. There isn’t a deficit of knowledge, rather there are different practices that don’t always align with mainstream expectations.

Indigenous understandings of their local economies are often built on notions of reciprocity. Addressing financial capability requires patience and time spent in the community, rather than a unidirectional, top down “mainstream-is-best” approach.

Financial institutions need to develop their own cultural literacy to better serve and respond to remote Aboriginal communities.

Read more: Royal commission scandals are the result of poor financial regulation, not literacy[4]

Broadly conceived, the federally funded Financial Wellbeing and Capability (FWC) program[5] specifically aims to improve financial literacy for vulnerable individuals and groups nationwide.

It’s an argument that says the route out of poverty is to better understand financial decision making. Yet research has shown to be receptive to mainstream financial literacy programs, patience is key[6].

Our research[7] was based on a deep qualitative engagement and evaluation of CatholicCare NT[8]’s financial well-being program in the Northern Territory.

The research revealed the extent to which certain financial products are simply inappropriate or poorly understood. This is compounded because financial concepts in and of themselves often do not relate or have traction in the everyday lives of many in remote communities.

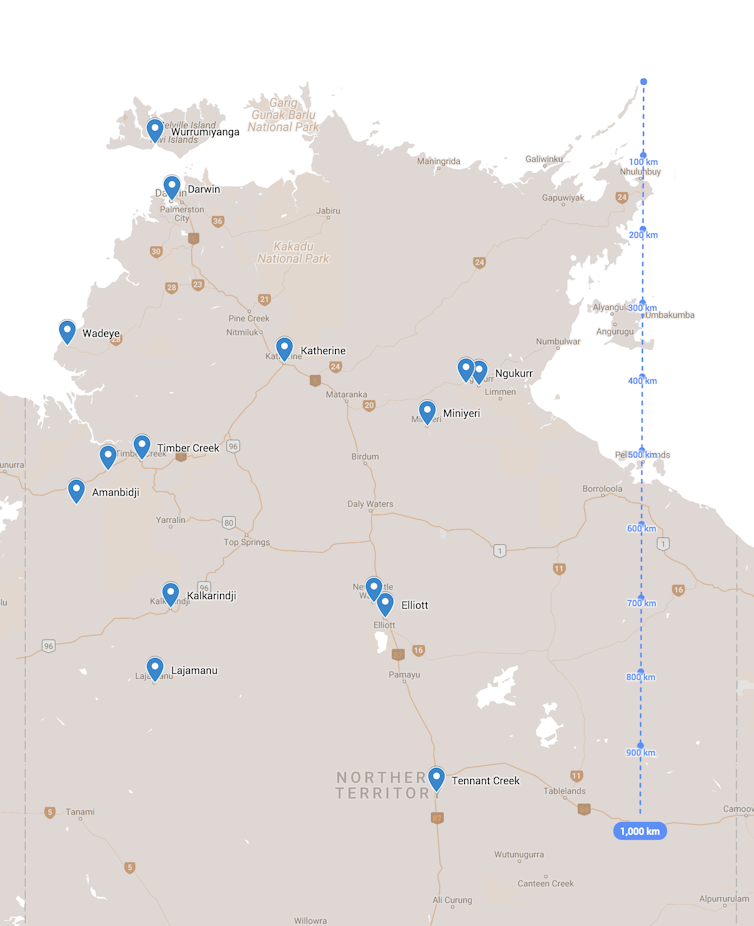

Map of communities visited with CatholicCare NT FWC teams. Distance and remoteness add considerable challenges to service providers.

Google Maps

Map of communities visited with CatholicCare NT FWC teams. Distance and remoteness add considerable challenges to service providers.

Google Maps

Interest on a bank loan is an excellent example. If you have limited exposure to mainstream economic practices then this can be an abstract concept.

When we asked Indigenous participants to explain what interest on a loan is, only 11% provided an explanation. With some additional analogies, on the second ask, this number rose to 39%. While the sample size for non-Indigenous participants was small, the figure for this group when asked the same question was 100%.

Read more: There are serious problems with the concept of 'financial literacy'[9]

The CatholicCare NT model is unique in that it has outreach teams who take time to develop culturally and community appropriate practices.

This is something that takes time and patience.

To address financial literacy issues it can’t be a top-down approach. Financial institutions need to develop their own cultural literacy to better serve and respond to remote Aboriginal communities.

Understanding and appreciating how social and cultural values underpin financial activities in a remote setting is key[10].

It cannot and should not be about telling people or communities how they must (or must not) share their economic resources. Developing financial capabilities has to be about addressing Indigenous financial exclusion, by aligning with localised concepts of well-being that reflect cultural expectations.

This can be expressed with reference to noted economist Amartya Sen’s capabilities approach, which is about expanding “people’s freedom to choose the kind of lives they want to lead, do what they want to do and be the person they want to be[11].”

Read more: Consumers need critical thinking to fend off banks' bad behaviour[12]

During our research we had a long conversation with an elder in a remote community. He made it quite clear “You can’t just come in like a fly and take-off”.

In all his years, he said this was the first occasion somebody “from town” had spoken to him about how “money stuff” should be dealt with and what he thought the solutions might be.

This was an exercise in listening and learning how local and Indigenous remote economies work – and to better understand the gap between these economies and the mainstream Western economy that has been imposed.

It’s the spaces in between these economies where strength-based outcomes can be achieved.

In one community, a clan group has set up a joint bank account. The account is for clan business or if there’s some sudden financial need. It represents a collective response and it’s a strong example of how gaps between these blurred economic worlds can be bridged.

If we wish to deal with a breadth of social issues – health, housing, family and relationship stress – dealing with Indigenous financial exclusion is a foundational issue as it relates directly to a person and to their community’s financial and material security.

While regulations around payday lending need tightening, it’s imperative programs like those run by CatholicCare NT continue to be funded.

In an era of increased financialisation[13], it’s these programs that are helping to shine a light while working alongside communities to overcome financial exclusion.

References

- ^ Banking Royal Commission’s trip to Darwin (financialservices.royalcommission.gov.au)

- ^ payday lenders and funeral insurers (www.abc.net.au)

- ^ Our research (www.catholiccarent.org.au)

- ^ Royal commission scandals are the result of poor financial regulation, not literacy (theconversation.com)

- ^ Financial Wellbeing and Capability (FWC) program (www.dss.gov.au)

- ^ patience is key (www.sciencedirect.com)

- ^ Our research (www.catholiccarent.org.au)

- ^ CatholicCare NT (www.catholiccarent.org.au)

- ^ There are serious problems with the concept of 'financial literacy' (theconversation.com)

- ^ social and cultural values underpin financial activities in a remote setting is key (mams.rmit.edu.au)

- ^ people’s freedom to choose the kind of lives they want to lead, do what they want to do and be the person they want to be (www.cdu.edu.au)

- ^ Consumers need critical thinking to fend off banks' bad behaviour (theconversation.com)

- ^ financialisation (www.palgrave.com)

Authors: Jonathon Louth, Research Fellow, Australian Centre for Community Services Research, Flinders University